Boost Your Wide Range Monitoring With Devoted Tax Providers for Estate Planning

In today's complex financial landscape, enhancing your riches monitoring approach via committed tax obligation solutions for estate planning is not just advantageous; it is important. As individuals come to grips with the ins and outs of asset circulation and tax obligation implications, understanding just how targeted tax approaches can guard and optimize the transfer of riches comes to be extremely important. By exploring the junction of tax efficiency and estate planning, one can discover important insights that not just strengthen financial safety and security but likewise ensure a smooth heritage for future generations. What techniques might you be forgeting that could substantially impact your estate's monetary health?

Value of Estate Preparation

A well-structured estate strategy encompasses various components, including wills, trusts, and powers of attorney. These tools make sure that a person's preferences pertaining to property distribution, health care choices, and guardianship of minors are clearly articulated and legally enforceable. Furthermore, estate planning can promote the effective transfer of assets, decreasing hold-ups and potential probate expenses that may occur without proper paperwork.

Moreover, estate planning is critical in dealing with possible tax obligation ramifications on inherited possessions, which can significantly influence the worth of an estate - Tax Planning. By proactively managing these factors to consider, people can guard their legacy and enhance the economic health of their recipients

Function of Tax Obligation Services

Navigating the complexities of tax guidelines is necessary for people and services alike, as tax obligation services play a crucial function in maximizing financial end results. These services offer experienced guidance on tax conformity, ensuring that clients comply with ever-changing tax obligation laws while optimizing their monetary potential.

Tax experts examine specific and business economic circumstances to determine tax obligation obligations and opportunities. They offer tailored approaches that straighten with wider wide range administration objectives, especially in estate preparation. By evaluating various property frameworks, tax obligation services can advise the most reliable ways to move riches to successors, lessening possible tax obligation concerns associated with inheritance and inheritance tax.

Moreover, tax solutions aid in the prep work and filing of tax returns, helping to prevent costly blunders that might set off audits or fines. They additionally stay abreast of legislative changes, making sure that clients take advantage of new tax motivations and stipulations - Tax Planning. Inevitably, the duty of tax solutions prolongs past mere conformity; it encompasses strategic preparation that enhances wide range conservation and growth. By incorporating tax obligation methods right into overall monetary preparation, clients can foster a much more robust monetary future that aligns with their individual and estate planning purposes.

Techniques for Decreasing Obligations

(Frost PLLC)One more reliable strategy entails optimizing reductions and credit ratings. People should preserve arranged documents of deductible expenditures, such as mortgage interest, medical expenditures, and charitable contributions. Companies can benefit from identifying qualified tax obligation credit histories, including study and development credit histories, which can dramatically reduce tax obligation concerns.

In addition, engaging in aggressive tax preparation is crucial. This consists of timing revenue and costs strategically; for example, deferring revenue to future tax years or increasing reductions in the existing year can generate desirable tax obligation ramifications. Using tax loss harvesting in financial investment portfolios can likewise reduce funding gains tax obligations.

Maximizing Inheritance Value

Optimizing the value of an inheritance calls for cautious preparation and tactical decision-making. To guarantee that heirs receive the full advantage of their inheritance, it is necessary to consider numerous elements that can affect its total worth. One crucial aspect is recognizing the tax effects linked with the inheritance, consisting of estate taxes and possible earnings taxes on inherited properties.

Using tax-efficient approaches can dramatically improve the inheritance value. Gifting assets during the donor's life time can lower the taxable estate, thus enabling beneficiaries to acquire more without incurring substantial tax obligation liabilities. Additionally, leveraging tax-deferred accounts, such as IRAs or 401(k) s, can aid maximize the growth possibility of the assets prior to circulation.

Furthermore, heirs need to analyze the timing of property liquidation. Keeping certain assets, such as actual estate, may yield much better long-term gratitude contrasted to instant sale. Conversely, selling off properties that are underperforming can avoid potential losses.

(Tax Planning)

Collaborating With Financial Advisors

Partnering with financial experts can dramatically improve the administration of acquired wide range, making certain that heirs make notified choices that straighten with their lasting economic goals - Tax Planning. Financial experts bring competence in financial investment methods, tax obligation ramifications, and estate planning, permitting heirs to navigate intricate financial landscapes with self-confidence

Efficient cooperation starts with establishing clear communication between the monetary expert and the heirs. Comprehending the household's worths, financial goals, and threat resistance is important in customizing a wealth management method that matches their unique situation. Advisors can then offer tailored recommendations that leverage tax-efficient investment cars and estate planning strategies, inevitably maximizing the worth of the inheritance.

Furthermore, routine meetings can aid keep track of development and make necessary changes to the monetary plan as situations develop. By promoting an aggressive connection, beneficiaries can stay enlightened regarding market patterns, tax law modifications, and appropriate economic items that may benefit their portfolio.

Final Thought

Incorporating devoted tax services into estate preparation significantly boosts wide range monitoring by making certain the efficient transfer of possessions and the minimization of tax obligation obligations. By leveraging tailored strategies and working Click Here together with economic advisors, people can take full advantage of the worth of inheritances while maintaining household riches. Ultimately, a comprehensive approach to estate preparation that consists of expert tax obligation advice promotes not just monetary safety but likewise harmonious partnerships amongst heirs during the distribution of possessions.

Josh Saviano Then & Now!

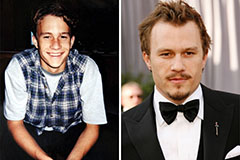

Josh Saviano Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!